Peak Office

#WF51 Why Return-to-Office mandates will fail and their role in the Trillion-Dollar Real Estate Debt Crisis

(If you prefer you can listen to this article as a Podcast 🎙️)

What is behind some of the rather desperate attempts to bring people back to the office? Is it really to improve productivity, to keep an eye on workers, or to justify some very large investments in offices.

A staggering $1.5 trillion of U.S. commercial real estate debt awaits repayment, prompting a closer look at the clash between return-to-office RTO mandates and a looming financial storm that really could reshape the future of work.

Office utilisation is about 21% in the US, which is about half the level before the pandemic. (Source - XY Sense, Kastle).

Reading the press, one might imagine most people can work from home.

However, 61% of US workers have jobs where they cannot work from home (Source - Pew Research Center) and 56% of UK workers do not work remotely (Source - ONS). Many workers will never be able to work from home because their workplaces include vehicles, factories, restaurants, shops, and hospitals.

About one third of workers say they want on-site jobs, a third want hybrid jobs and a third want fully-remote jobs (Source - LinkedIn Surveys). This contrasts with actual job vacancies where 60% of jobs are on-site, 30% are hybrid and only 10% are fully-remote. There are not enough remote jobs to fulfill worker demand.

The graph above shows that the proportion of workers in Germany who work from home has stabilised at around a quarter. This stablisation trend is similar in many other developed economies according to data from Professor Nick Bloom.

My hypothesis is that the number of jobs located in an office has peaked now. With automation and worker demand, there will be less need to work in the office.

There have been some high-profile employers with mandates for their workers to Return to Office RTO.

These include Amazon, Uber, Twitter, Starbucks, Meta, Google, Goldman Sachs.

So what is driving this Return To Office?

You will notice that the companies mentioned happen to be US-based.

Peak Office ROI

As you can see from the graph above, the US lags far behind Europe and Asia in return-to-office rates. The first reason is that these US-based employers want to get a better return on expensive investments in commercial property. These investments are typically long-term and property deals were made long before the Covid bugs. Much corporate messaging on RTO is aimed at nervy shareholders.

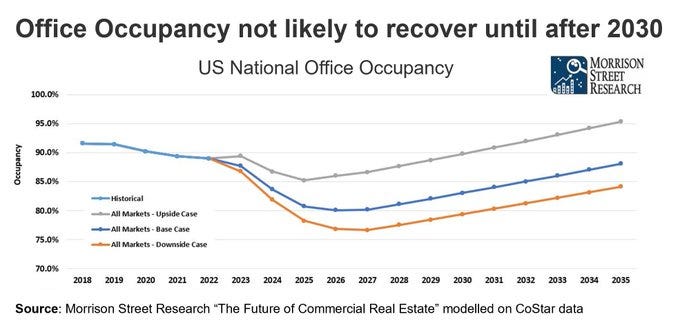

Almost $1.5 trillion of US commercial real estate debt comes due for repayment before the end of 2025. (Source - Bloomberg). A third of the long-term office leases expire by 2026. It will be interesting to what happens in terms of lower rents, or maybe conversion of offices to other types of property use in towns and cities.

A darker thought is, will this debt precipitate a commercial debt crisis?

Trillion dollar debt crises can sink broader economies, and have a much bigger impact on the workforce than any RTO mandate.

Peak Command and Control

The second big factor in the return-to-office mandate is continuation of Command and Control management techniques developed for the economy of the 20th Century.

This attitude can be illustrated with a view that “Productivity can only be maintained where I can see you working”. As opposed to a more empowering message, “these are the outcomes I expect from your work.”

This command and control mindset will still work for some highly-paid knowledge workers, and where people have few other decent employment choices. However, when there is competition for these highly paid knowledge workers, these tactics will fall apart.

Workers prefer to feel empowered than to be spied on.

There is already data that shows RTO mandates increase the flight-risk (attrition) for high-performers, women, and, millennials. (Source - Gartner).

The rhetoric of RTO mandates can also provide linguistic cover for redundancies and lay-offs.

Peak Water Cooler

There is a belief that by squeezing people physically together in the same space, you will automatically improve innovation.

The academic studies do not give a clear picture on what works. The context might not relate to your organisation e.g. lots of startups, scientists in laboratories, and MIT professors.

We need to build a collage of evidence to work out what will increase workforce productivity, specifically for your workforce.

Specific tactics to try include increasing cross-team collaboration, and encouraging experimentation.

In summary, there will always be the need for workers to collaborate in person sometimes and they will need suitable space to do this. However, it looks like the number of days working at the office will reduce over the coming years.

To attract and retain workers, employers will need to deploy more sophisticated measures than RTO mandates.

What Do You Think?

Please give your gut reaction to this Workforce Futurists Poll →

Some Questions for Workforce Futurists

How will successful employers evolve to enable self-managed teams and improve productivity and also worker wellbeing?

How important a factor is the location of work, compared to how we work, why we work, and who we work with?

How will our towns and cities change if there are less offices?

Let me know your thoughts, simply by clicking reply (if you subscribe) or adding a comment.

Before you Clock Out

This article on Peak Office is the first of a planned series on some workforce trends that are declining and those that are growing, some exponentially.

If you haven’t already, do make sure you subscribe to Workforce Futurist Newsletter.

If you enjoyed this article, you might also like the follow-up article too…

The Last Call of the Corporate Peacock🦚

(This episode is also available as a Podcast🎙️) What is behind the 5-day Return-To-Office (RTO) mandate by larger employers? There is no evidence that RTO leads to long-term productivity improvements. My last article, Peak Office, argued that the two major fac…

To help me develop better content and services please consider sharing this newsletter with your network. It remains independent, free and written by Andy Spence, an experienced management consultant and horizon-watcher.

The image is of the newly constructed Surat Diamond Bourse, a hub for the diamond industry, accommodating over 65,000 professionals including cutters, polishers, and traders. The sprawling complex has 659,611 m² (7.1 million sq. ft) of floor space, spanning 35 acres of land, surpassing the USA’s Pentagon as the world’s largest office building.