Retiring Retirement

Why it's time to rethink retirement, manage our careers with intention, and plan for a life without a fixed end date to work.

When do you plan to retire?

Typical answers range from ‘when I have enough cash’, ‘never’, or ‘when I’m 64 🎸’…

The average 20th-century worker studied for 20 years, worked for 45 years, retired at 65, then died 14 years later.

An industrial mindset told us when we could learn, earn and when we had to stop.

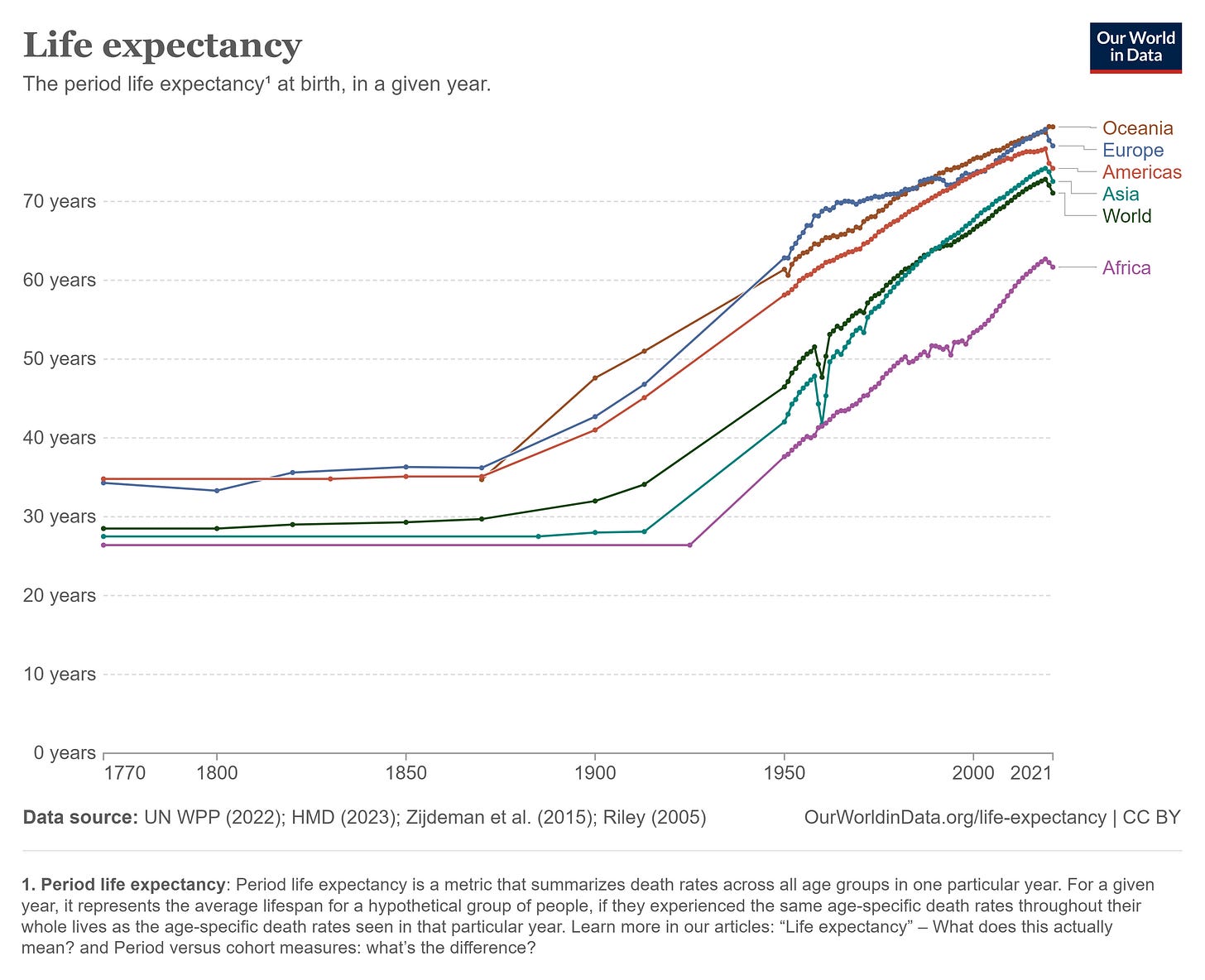

Today, the average life expectancy of women in France, Italy and Japan is past 86 years.

Babies born today in richer countries are expected to live past 100 years old.

Work is dissolving from steady jobs into platforms, shorter contracts, AI bots.

As we rethink the very concept of work, we need to consider how we pay for those who no longer work.

This article argues that the 20th-century concept of Retirement should be Retired, it outlines alternative mental models for individuals around financial freedom, with some examples from countries and employers around the World.

What Have The Romans EVER Done for Us?

After 20 years of military service, in the Roman Empire a soldier was rewarded with citizenship and 10-13 years of pay. Another idea that started in ancient Italy and re-imagined by industrialisation. Otto von Bismark introduced Germany’s first pension service in 1889, offering support to those over 70. Retirement was defined as a life stage, and governments saw the need to support aging populations, with the U.S. launching Social Security 1935.

However fast forward a century or so and we have some tension with pensions.

Pension Tensions - A System Under Pressure

The traditional three-legged stool of retirement - state pensions, occupational pensions, and personal savings - is wobbling.

Consider the warning signals :

We are living for longer, but retiring at a similar age. It’s great news that we are living longer healthier lives, as the graph below illustrates.

However the average retirement age has barely shifted over the past 50 years, hovering around 65 to 68. In the 1970s, a retiree might have only 10 years of retirement to plan for, in the 2020s, this is nearly twice as long.

The Roman pensions were so costly in the end that they accounted for up to 80% of state spending, forcing emperors like Augustus to implement inheritance taxes and extend service time to keep up with the expense. Richer countries today can just about pay for pensions, but the cost is soaring. For example, the UK State Pension requires £200k in equivalent savings to provide a basic income, for a median salary of £35K (Source IFS). As Merryn Somerset Webb points out state pensions might be means-tested in the future, based on individual needs. In her view, there aren’t many things that could bring the mild mannered British middle classes on to the streets - but not getting what they think they paid for pension-wise is one of them.

The Job is Deconstructing. Younger generations are less willing to work for a boss and be mandated to work in a soulless office. 40% of Gen Xers plan to work part-time through retirement. Nearly half of Generation X doesn't believe they'll have enough saved for a comfortable retirement. 1 in 7 Americans have worked in the gig economy – without pension contributions. Less quality jobs means less pension contributions.

It’s a waste of Skills and Talent. As the population ages, 70 is the new 60. We are healthier and better able to work than the last generation – due to medical advances. Forcing skilled and talented individuals to stop work at an arbitrary age is a waste.

Financial inequality. 2 billion people in the global workforce work informally without basic legal rights, let alone private pension provision. Globally, only 68% of retirement-age individuals receive any form of pension.

Disparity between Men and Women. Women need to work for an extra 19 years to retire with same pensions savings as a man in the UK, according to Pensions Policy Institute. In the United States, in the second quarter of 2021, women over age 65 had median weekly earnings that were 72% of men's, earning $816 compared to $1,141.

Retirement Shock. In the 1970s, British postal workers had some of the shortest retirement spans, 7 or 8 years on average. For teachers this was 12-15 years. Things have improved today, but reasons in studies at the time gave physical demands of long hours on foot for posties. There is also the less dramatic retirement shock to the spouse of having to share their home with their partner during the day time.

So the pension and retirement concept is wobbling,

These are long-term structural issues with financial security, pension and retirement that will probably take decades to work out, so what can we do as individuals?

This is a longer article - here is a link to read “Retiring Retirement” in a browser.

Taking Charge: Managing Your Career and Finances

I think we need to rethink our conceptions of Work, Leisure, and Wealth.

We need to strive for financial independence in a way that suits our needs, and of course take more personal control of our careers and finances than in the 20th Century.

Strive for Financial Independence. Whether you are 20, 40 or 60. Start saving up for a fund that pays your expected expenses when you stop getting paid for work. (see below for some ideas on this). Pensions are a rather rigid way to provide a regular income stream when your work income stops. The pensions industry is full of poor advice, vested interests and somebody willing to take 1.5% of your savings at every stage in the process.

Take control of your work and finances. You should decide when you want to stop paid work, not the state or employer. We can’t assume our state or employer will look after us in the same way today in a few decades time. If 50% of your financial security is in an employers’ investment fund – then make sure you know about the fees you are paying and how the fund is performing against the benchmarks. Understand the rules in your country to make sure you receive the state pension. Take an interest in personal finance and find a trusted financial advisor. (I have included some useful resources at the end of this article)

Do work that gives you fulfilment and aligns with your values. This has always been the goal hasn’t it? You will not want to stop. Paid, unpaid, recognised, valued - it doesn’t matter. The solution to the retirement problem for individuals is to do work you never want to retire from. I will continue to write about building a better future of work until you stop reading my articles or stop coming to my talks!

Stay healthy. There is no point in working relentlessly for 30 years to save for your Lifetime Expenses Fund, but then spend the rest of your life lonely and battling chronic avoidable lifestyle diseases. That would be very 20th Century - but arguably better than a Roman soldier, where only 50% even made it to retirement.

21st Century Careers aren’t like your fathers’ careers. We will be constantly working on projects, caring, convalescing and earning and learning at different paces. Instead of 1 or 2 careers, we will be having 100 different careers and 100 different lives, or as Matteo refers to - many lateral careers.

As you master work and learn more about your financial tactics for you and your family, I suspect your notion of retirement will change.

This is my personal perspective, all these are easier to say than do, and very much depend on your context, where you live etc

Please share your thoughts in the comments.

Come on Baby Light my FIRE🔥

When Will You Stop Working?

In our poll in an earlier article, (which is still open) 73% of readers indicated that they will stop working when they have enough cash saved. Financial security is an important aspect of when to stop working.

There are a group of individuals who are deeply into the concept of Financial Independence. A quick scan on the Reddit groups shows this is quite a diverse group of individuals, from the Google Executive, able to save 50% of a substantial income, to the young family just about breaking-even every month.

FIRE stands for Financial Independence and Early Retirement

The core philosophy is about taking control of your financial life to gain the freedom to pursue your passions without being constrained by traditional employment.

Tom and Lisa, a couple from the UK, embraced the FIRE mindset in their 40s despite modest incomes. They focused on ‘frugal living’ to save 30% of their combined salaries, cutting down on expenses like dining out and choosing budget-friendly vacations. Over 15 years, they invested in stocks and bonds, which provided them with a stable passive income stream. By 55, they’d reached financial independence and could both downshift their jobs, allowing them to spend more time on their hobbies and with family.

Another example,

Luca, a freelance web developer in his 20s, took a unique path to FIRE. He minimized his living expenses by moving to lower-cost countries like Thailand and Vietnam, where he could live comfortably while saving over 50% of his income. By investing in a diversified portfolio and keeping a minimalistic lifestyle, he achieved financial independence by 35. Now, Luca has the flexibility to work on freelance projects he’s passionate about, travel, and live on his terms.

The aim is to reach a point where your investments generate enough passive income to cover your living expenses. This financial independence allows you to retire early or choose work that's meaningful to you, free from financial pressures.

The underlying Philosophy tends to push

Empowerment - Taking responsibility for your financial future empowers you to live life on your own terms.

Intentionality - Being deliberate about your choices leads to greater satisfaction and less waste. We can all make smarter choices even though we all have very different options.

Freedom over Luxury - Valuing time and freedom more than accumulating material wealth.

This way of thinking challenges conventional notions of success and retirement, proposing that with discipline and strategic planning, one can achieve a fulfilling life sooner rather than later.

Key Principles for achieving FIRE include :-

Living below your means: to save a significant portion of your income, accelerating wealth accumulation.

Smart Investing: Putting your savings to work through investments in stocks, bonds, real estate, or other assets that appreciate over time.

Frugal Living: Making conscious choices to reduce unnecessary expenses, focusing on value rather than consumption.

Mindset Shift: Changing how you view money and success. Instead of equating happiness with material possessions, the focus is on financial freedom and personal fulfillment.

Life Design: Actively shaping your life to align with your values and goals, which may include downsizing, simplifying, or pursuing alternative career paths.

Continuous Learning: Educating yourself about personal finance, investing, and self-improvement to make informed decisions.

I have put some useful FIRE resources at the end of this post.

How Much Do you Need to Stop Working?

This is the million dollar question for most people.

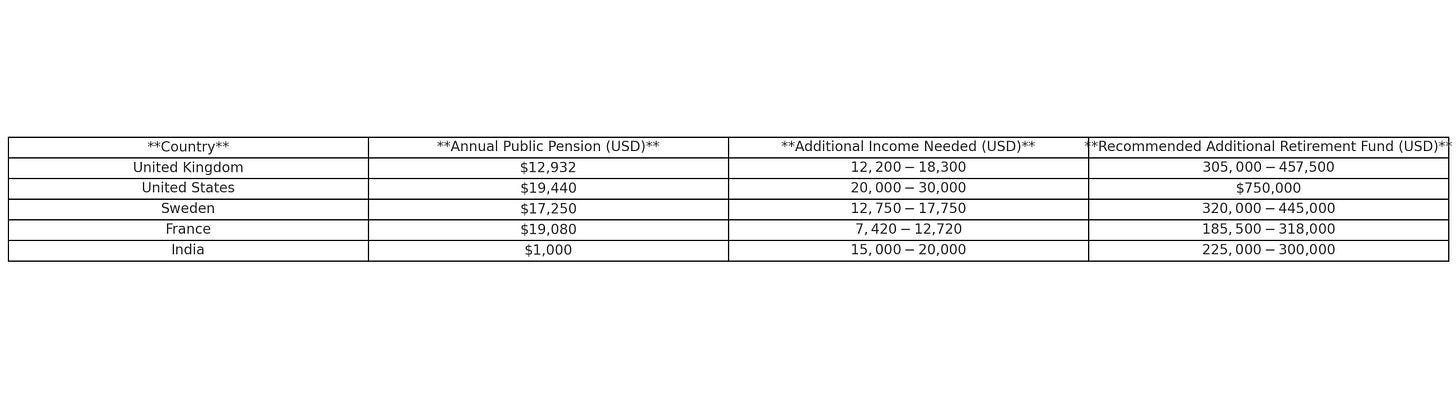

If you retire at 66, and want a median lifestyle, you will need a fund to support you.

Here is a crude summary of the additional fund you will need in selected countries.

To determine how much cash you’ll need to stop paid work in a future scenario, we break it down into key steps :-

determine your goals and lifestyle - location, travel etc.

estimate annual expenses including housing, food, healthcare etc

assess sources of income from state and private pensions, savings, investments

multiply by 25 to set an adjusted target (this is the the 4% rule – ask an actuary if you dare). Example if your estimated annual expenses are $50k, you will need $1.25m.

Now you have your Lifetime Expenses Fund - get saving, spending less and planning your future.

So how are countries and companies responding to the ageing workforce?

How Countries and Companies Are Responding

Here are some selected example from around the World on how countries and employers are responding to the aging workforce.

Increase the retirement age - with people living twice as long after retirement than the 1970s - this is the obvious response. In China the retirement age is set as 63, for women it varies from 55 for blue-collar workers to 58 for white-collar workers. Many others have retirement between 64 and 66.

Sweden has led Europe in offering flexible retirement options - Swedes can choose to retire between ages 62 and 68, and many choose to work part-time, collecting partial pensions while staying engaged in the workforce. Germany also has the ‘Altersteilzeit’ program, a form of phased retirement for older workers that allows them to transition gradually.

Intergenerational Knowledge Transfer and Training Programs - in France, companies like Airbus and Renault have set up ‘intergenerational contracts’ offering financial incentives to older employees to train younger workers before they exit the workforce.

Conclusion

The 20th-century model of retirement is becoming as obsolete as the Roman military pension system. As we face the prospect of 100-year lives, we need new paradigms that support meaningful, sustainable ways of living and working across all life stages.

The concept of retirement is creaking as the populations ages, more work in the gig economy, and industries get transformed by the digital revolution.

There are many sensible tactics for individuals to design their lives, their work, their finances.

Employers and countries are adapting far too slowly, with serious repercussions.

Finally DYOR - Do Your Own Research. Nothing in this article constitutes financial advice🤦🏼. Every person has a different context and there are no black and white answers here.

The social solutions are not to abandon retirement, but to reimagine it for the 21st century.

Further Resources

Retire in Progress - some smoking hot 🔥 FIRE thinking and resources from Mr Rip.

AARP Retirement Planning Tools (US) - The American Association of Retired Persons (AARP) offers calculators and resources for retirement planning.

National Insurance Contribution Credits (UK) - make sure you don’t miss out on crucial pension contributions to be eligible for the full state pension.

Pension Wise (UK) - A government service offering free, impartial guidance on defined contribution pensions.

HerMoney - by Jean Chatzky - articles, podcasts and webinars on money management and retirement.

Clever Girl Finance - by Bola Sokunbi - valuable tips on investing, free courses, budgeting, and careers.

Redirecting Work - by Lexy Martin - lots of interesting personal stories and thinking, find out about Cocooning and check out the interviews with individuals working in Work Tech and Future of Work.

Ellevest (US) - designed specifically for women, Ellevest provides investment and retirement planning services, educational content, and financial coaching.

Awaiting your 50-year life plans,

Andy